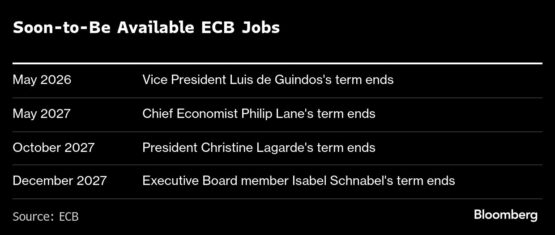

The European Central Bank is embarking on a two-year transformation that will result in the exit of two-thirds of its senior leadership, including President Christine Lagarde.

This initiative aims to overhaul the six-member executive board, influenced as much by political dynamics as by individual capabilities, and may begin this week at the euro-zone finance ministers’ meeting in Luxembourg. Discussions might start regarding a successor to Lagarde’s deputy, Luis de Guindos.

The nominations from member states regarding candidates, along with their endorsements, may mirror aspirations for more prominent roles in the future: both the chief economist position and the presidency will be up for grabs in 2027.

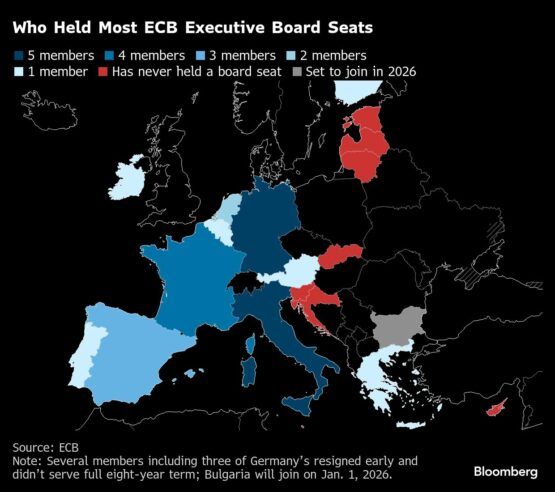

Germany and France, the region’s leading economies, are competing for these positions. Together with Italy, they have historically ensured representation on the board. Spain and the Netherlands are also strong competitors, while Eastern European nations aim to secure their first seat and Southern countries seek recognition for emerging more robustly from the debt crisis than many Northern counterparts.

Striking a balance between large and small nations, northern and southern regions—while ideally ensuring gender parity—will be vital. For the new appointees, the challenges extend beyond simple interest rate adjustments. They must adeptly manage an expanding currency zone amidst structural changes, confront a fragmented global landscape, and implement a digital currency aimed at bolstering economic security while enhancing the euro’s global standing.

The following overview of potential candidates, prior to assessments by the ECB, European lawmakers, and regional leaders, is gathered from discussions with individuals familiar with governmental strategies and the candidates’ motivations, who requested anonymity on sensitive matters.

ADVERTISEMENT

CONTINUE READING BELOW

Vice Presidency

Olli Rehn, Governor of the Bank of Finland, is rumored to be interested in Guindos’s post—he is a seasoned policymaker with experience across central banking and political realms.

With a history as a three-time European Commissioner and his country’s economy minister, alongside roles as both a national and European legislator, Rehn stands as a strong candidate. His centrist views add to his appeal, but he may face competition from notable female candidates recognized as central bank deputies, including Clara Raposo from Portugal and Christina Papaconstantinou from Greece.

Both countries have previously held the ECB’s vice presidency, while current Greek Governor Yannis Stournaras might also enter the race. Some nations might prefer the appointment of a woman as vice president to facilitate later nominations of men for the top role.

Other possible contenders include Nadia Calvino of Spain, leading the European Investment Bank, and Maria Luis Albuquerque, Portugal’s Financial Services Commissioner. Italy is likely to take a step back since Piero Cipollone has just embarked on his eight-year term on the Executive Board.

Boris Vujcic, head of Croatia’s central bank who guided his nation into the euro in 2023, is another candidate to consider. His expertise also positions him as a possible choice for the chief economist role, which Philip Lane has held since 2019 after missing out on the vice presidency.

Chief Economist

This role, while lesser in hierarchy and salary compared to the vice presidency, possesses significant influence. Beyond overseeing critical quarterly forecasts, it’s the chief economist’s duty to recommend interest rate shifts during monetary policy sessions.

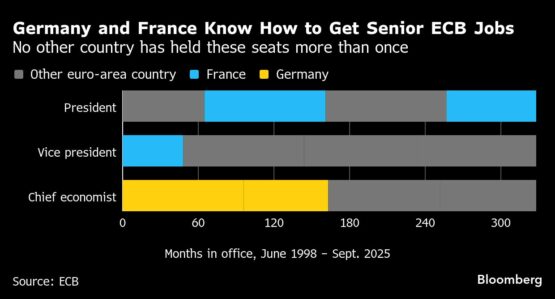

This position is particularly appealing for France, which may not achieve a third presidential term after Lagarde and Jean-Claude Trichet but aims to maintain substantial influence.

ADVERTISEMENT:

CONTINUE READING BELOW

Laurence Boone, a former OECD chief economist who has worked with Presidents Francois Hollande and Emmanuel Macron, leads Santander’s French branch and is a potential candidate. Others in consideration include economics professor Helene Rey, Bank of France Deputy Governor Agnes Benassy-Quere, and IMF chief economist Pierre-Olivier Gourinchas.

Germany may also show interest if the presidency appears unattainable. It has held this role twice previously—with Otmar Issing at the euro’s launch and Juergen Stark thereafter.

Presidency

The race to replace Lagarde began even before her tenure commenced, with many viewing her predecessor Mario Draghi as prepping Spain’s Pablo Hernandez de Cos for the presidency.

De Cos led his country’s central bank from 2018 until 2024 before moving to the Bank for International Settlements. His impressive professional background may be offset by his political connections and recent transition to the BIS.

Klaas Knot is another contender. After fourteen years at the helm of the Dutch central bank, he became the longest-serving member of the Governing Council upon his retirement in June. His credentials in economics and oversight, along with a chairmanship at the Financial Stability Board, make him a strong candidate to succeed Lagarde.

Lagarde praised Knot in a podcast released on Sunday, describing him as a fitting successor, citing his intellect, stamina, and rare ability to include others as vital skills.

The future largely hinges on Germany’s stance regarding both de Cos and Knot, as the German government explores securing the presidency for the first time.

ADVERTISEMENT:

CONTINUE READING BELOW

Bundesbank President Joachim Nagel would make a reasonable contender—primarily due to his efforts to define moderate policy stances that have wide appeal. However, his political backing could be complex due to his ties with Chancellor Friedrich Merz’s opposition party.

Isabel Schnabel, whose tenure on the Executive Board concludes just two months after Lagarde’s, may also express interest. Although her current role could present hurdles, ECB lawyers believe that maneuvering past these should be possible through a loophole identified in 2018.

Germany’s chances may be somewhat curtailed by its current hold on other significant European positions—particularly with Ursula von der Leyen’s presidency of the Commission running through 2029, along with Claudia Buch’s leadership of the ECB’s Supervisory Board.

A wildcard contender could also appear: Lagarde’s appointment indicates that previous experience in economic or central banking roles is no longer a strict requirement.

Executive Board Seat

The board position set to become available when Schnabel’s non-renewable term ends in late 2027 could serve as a potential fallback for Germany and France if they are unable to secure previous roles. It might also represent an opportunity for smaller nations.

This could signify Eastern Europe’s prime opportunity for advancement, whether through Vujcic or candidates like Latvia’s Martins Kazaks or Slovenia’s Bostjan Vasle.

An additional opening could arise if Frank Elderson opts for early resignation as his five-year term as vice chair of the Supervisory Board concludes next year, reminiscent of Sabine Lautenschlaeger’s earlier exit. Following conventional practices, Elderson may also choose to step down should fellow Dutchman Knot be appointed president.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.